Please click here to login into Discovery Digital Id

The beauty of compound interest

A quote about compound interest being “the eighth wonder of the world” is often attributed to Albert Einstein. Whether the famous physicist actually ever said these words is up for debate, but the sentiment about the value of compound interest is not.

Compounding is the central pillar of investing – it is the reason investing works over the long term. Investopedia describes it as “the process of generating earnings on an asset's reinvested earnings”. Simply, over time, you are earning returns on previously reinvested money. Or, interest on interest.

Reinvestment of returns

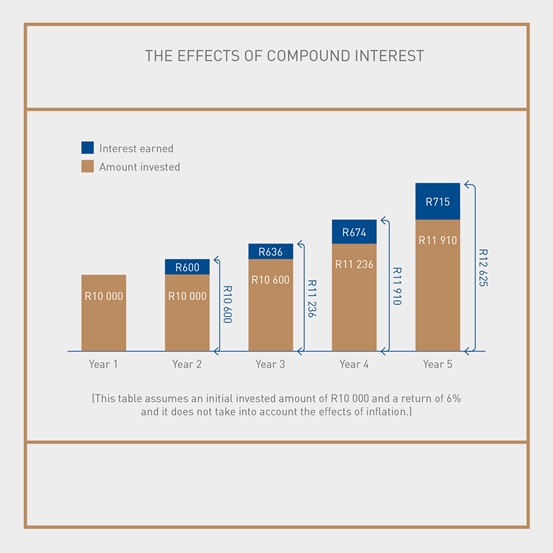

Reinvestment of returns is key and it makes a fundamental difference. Saving R10 000 at a return of 6% and withdrawing your interest every year means at the end of 10 years, you’ll still have R10 000, with R600 each year in returns (or R6 000).

But reinvest the returns and by year two you’re generating returns on R10 600; by year three you’re generating returns on R11 236, and so on. You are earning more interest each year because the amount invested each year is increasing, without you making any additional investments.

The compound interest gained on the initial amount of R10 000 may not seem significant, but if applied to larger figures the effect of compound interest becomes substantial.

And time is everything. No wonder financial advisers urge you to start saving when you are in your 20s or 30s. You have time on your side and that alone is half the battle won.

Time – an investor’s ally

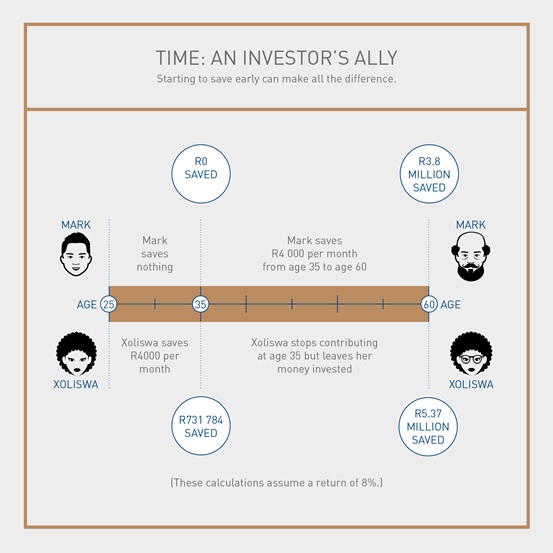

Saving for as many years as possible can have a very positive effect – thanks to compound interest. This is illustrated by the story of Xoliswa and Mark.

Let us imagine two university graduates, Xoliswa and Mark, both starting out their careers.

From age 25, Xoliswa saves R4 000 a month in a unit trust a steep ask, but she’s disciplined. Over time, the unit trust she’s invested in generates a return of 8% per year, on average. After a decade, by age 35, her investment will be worth R731 784. The amount she’s saved every month totals R480 000 but the rest of that growth – R250 000 – is all due to compound interest. At this point, Xoliswa decides to stop her monthly contributions.

Leaving compounding to work its magic means her investment will have grown to R5.37 million by age 60. Remember, this is with no additional contributions.

Mark, on the other hand, is 35 when he decides he needs to make sure he has money saved for retirement.

He also saves R4 000 a month in a unit trust, and is also lucky enough to receive an average return of 8%. He is starting later than planned, but he’s certain he will catch up to Xoliswa: he has 25 years until he retires.

By age 60, Mark will have R3.8 million saved, and he is happy. His contributions over this time will amount to R1.2 million, with interest totalling R2.6 million. Compounding did the trick for him too.

But because of the benefit of time – a head start of 10 years – Xoliswa has over R1.5 million more saved, despite contributing only 40% of what Mark contributed (R480 000 versus R1.2 million). Those 10 years make a remarkable difference, and illustrate the benefit of saving – and putting compound interest to work – as early as possible.

But if you are more like Mark, and have not started saving yet, do not panic. You always have time ahead of you. The most important thing is just to start.

For more information on investing, speak to your financial adviser.

This article is part of an investment series by Discovery Invest.

Discovery Invest is an authorised financial services provider. Registration number 2007/005969/07. For more information on Discovery Invest, contact your financial adviser.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell investment funds.

Invest

Because people have different goals, they need to invest differently. Discovery Invest offers a choice of investments, each one able to be tailored to...

Invest today